Blog

3 automation trends learned during North America’s largest automation event, Automate 2024

This week, over 35,000 automation enthusiasts traveled to Chicago, Illinois, USA for the largest automation event in North America. Automate Show hosts the widest and most inspiring showcase of automation, robotics, vision, motion control and more.

At the show, analyst firm Interact Analysis hosted a market briefing during which they examined the global manufacturing economy, its biggest challenges and their automation solutions. This market analysis proved true in our conversations on the show floor, where attendees watched potential automation solutions in action. These are the top 3 takeaways from Automate 2024:

- While production growth is low in 2024, it is expected to increase by 15% in the next 4 years

- Manufacturers are implementing automation solutions now to future-proof their operations

- Manufacturers came to Automate to assess potential automation solutions

1. While production growth is low in 2024, it is expected to increase by 15% in the next 4 years

Manufacturing production is impacted by the availability of raw materials, demand, labor and inventory costs, global conflicts and more. Since 2021, production has been slowly declining, reaching its lowest point since 2020. According to Deloitte, manufacturers are facing economic uncertainty in 2024, caused in part by the “ongoing shortage of skilled labor, lingering and targeted supply chain disruptions, and new challenges spurred by the need for product innovation to meet company-set net-zero emissions goals.”

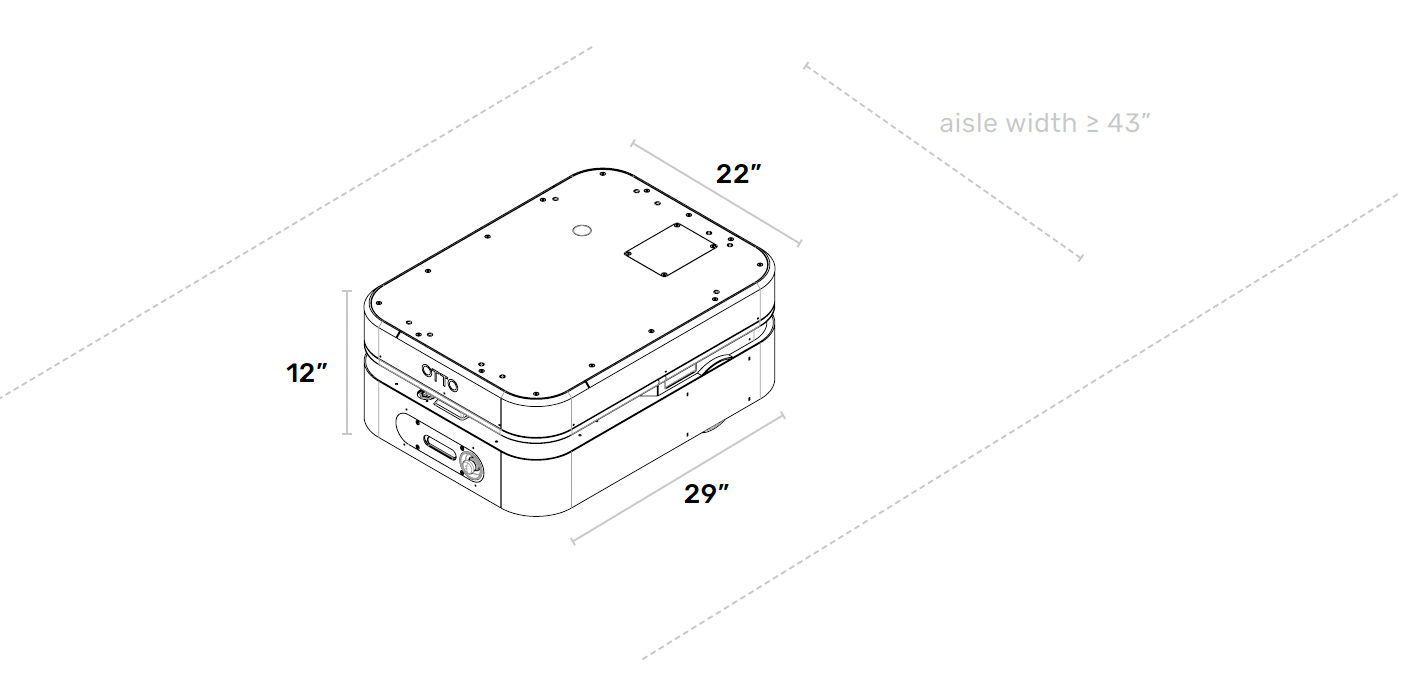

Despite this “down cycle” year, Interact Analysis predicts a significant recovery starting in 2025, with an increase of 15% by 2028. This predicted increase can be attributed to a variety of factors, including an increase in electric vehicle manufacturing in the automotive industry. Many manufacturers coming to our Automate booth discussed the restructuring of their plants to meet regulated electric vehicle (EV) production targets.

Image 1: The long-term forecast for EV sales in the United States, with nearly 30% of car sales coming from EV sales in 2030, according to EVAdoption.

2. Manufacturers are looking for automation solutions now to future-proof their operations

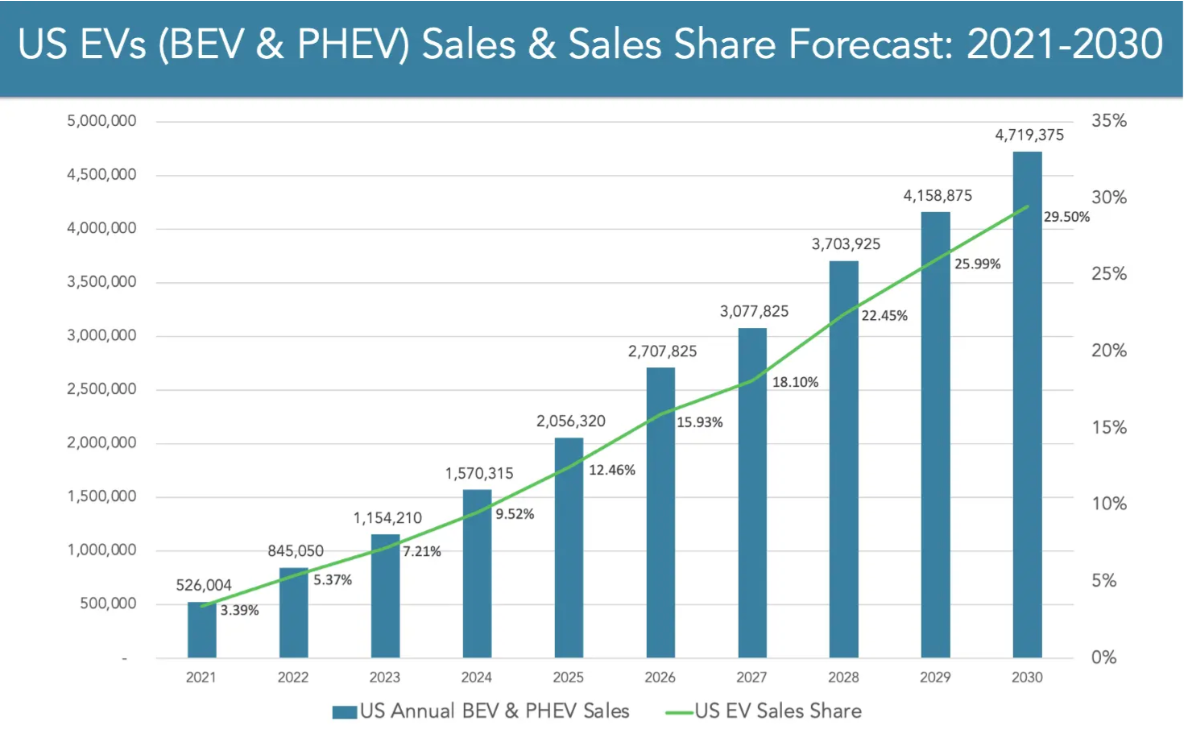

Amid the expected growth in production, manufacturers are thinking about how they will prepare their facilities and drive positive business outcomes, with most manufacturers (43%) turning to increased automation. According to the Interact Analysis market briefing, mobile automation—a solution which 46% of manufacturers plan to adopt—is being implemented for two main reasons: to reduce operating costs (35%) and to increase productivity (29%).

Image 2: The top four reasons manufacturers are implementing mobile automation solutions, according to Interact Analysis.

Automate attendees were concerned with future-proofing their operations to continue to meet productivity targets in the face of expected fluctuations in production capacity and labor availability. Similar to years’ past, manufacturers on the show floor described their need to elevate their available workforce to more fulfilling jobs that require uniquely human skills. According to Interact Analysis, 3 of the top 5 drivers to adopt mobile robotics included a lack of labor, rising labor costs, and a need to reduce manual/strenuous labor. Many manufacturers on the show floor were among the 83% that plan to adopt robotics and automation technologies in the next 5 years.

3. Manufacturers came to Automate to assess potential automation solutions

Automate hosted over 800 exhibitors showcasing robotics and automation solutions for manufacturers to evaluate as they prepare for predicted production growth. From autonomous forklifts to robotic palletizers to paint-defect inspection solutions, the show had an automation solution for attendees across a variety of industries. Attendees could even witness robotic arms holding cymbals for a drum set, playing black jack with attendees, mini golfing, and serving beverages.

01/06

One of the main mobile automation solutions manufacturers came to Automate to evaluate was autonomous mobile robots (AMRs), a top 3 area of investment for manufacturers. In fact, according to the Interact Analysis briefing, the AMR market is valued at close to $2 billion today—which has quadrupled since 2018—and is expected to rise to $6.75 billion by 2027.

Image 3: The forecast for AMRs is expected to grow exponentially, continuing to surpass automated guided vehicle (AGV) sales from 2023 through 2027.

To help manufacturers differentiate between the many AMR solutions in the market, OTTO walked attendees through the “8 key considerations when assessing AMR vendors” and shared a worksheet of key questions to ask each vendor related to the 8 considerations, including use cases, fleet management, service and support, and more.

Automate brought together automation enthusiasts from around the world to witness some of the greatest innovations in the market today. Manufacturers walking the show floor were excited to explore solutions to future-proof their operations amid the predicted rise in production starting next year. The OTTO team is excited to exhibit at Automate 2025 to learn the latest industry trends and solve manufacturing challenges of today and tomorrow.