Blog

iRobotics industry set for seismic change as growth shifts from fixed automation to mobile systems in enterprise

Originally posted on Robotics Tomorrow on December 10th, 2019.

The robotics market is set to transform over the next 10 years, based on the most comprehensive robotics tracker yet released by global tech market advisory firm, ABI Research. There will be enormous growth across all subsectors, highlighted in a total market valuation of US$277 billion by 2030. That growth will not be distributed evenly, however. By 2022, the burgeoning mobile robotics space will start to overtake the traditional industrial robotics market. Currently, mobile autonomy is concentrated in material handling within the supply chain, but mobile robots are set to touch every sector of the global economy for a wide range of use-cases.

Everyone talks about self-driving passenger vehicles, but mobile automation is far more developed in intralogistics for fulfillment and industry. The automation of material handling will see huge segments of the global forklift, tow truck, and indoor vehicle market consumed by robotics vendors and Original Equipment Manufacturers (OEMs) that bring indoor autonomy.

Rian Whitton

Senior Analyst, ABI Research

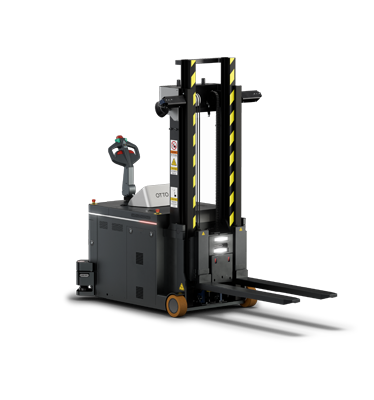

Image 1: OTTO Omega—the first truly autonomous lift truck—is the automation of the future.

The distinction between AGVs and AMRs can be contested, but AMRs do not require external infrastructure to localize themselves and are built with sensors and cameras to self-navigate their environments. Currently, AGVs represent the majority of mobile robot shipments, but by 2030, this will change. While there will be 2.5 million AGVs shipped in 2030, the total shipments of AMRs will reach 2.9 million in the same year. This is due to the declining costs of superior navigation and the desire to build flexibility into robotic fleets. “Many new verticals, like hospitality, delivery, and infrastructure, will demand systems that do not require external physical infrastructure to move about. While AGVs will thrive in intralogistics for fulfillment, especially in greenfield warehouses, AMRs solve the challenges faced by many end-users by offering incremental automation that does not require a complete change of environmental infrastructure,” Whitton explains.

In a major example of automation extending to new and important vehicle-types, the shipments of automated forklifts are set to grow from 4,000 in 2020 to 455,000 in 2030, with a CAGR of 58.9%. Meanwhile, the revenue for all mobile robotics is expected to exceed US$224 billion by 2030, compared to US$39 billion for industrial and collaborative systems. This opportunity is leading vehicle manufacturers such as Toyota, Yale & Hyster, and Raymond to partner with robotics companies to offer automation to manufacturers. Given the global shipments for forklifts is close to 1 million, half of all shipments could be automated by 2030.

Chart 1: Shipments of automated forklifts will increase from 4,000 in 2020 to 455,000 by 2030.

As mature sectors of the robotics industry achieve growth more in line with established technology markets, mobile robotics are set to create lasting transformative effects across the supply chain and will become increasingly ubiquitous throughout the global economy.

Rian Whitton

Senior Analyst, ABI Research

These findings are from ABI Research’s Commercial and Industrial Robotics market data report. This report is part of the company’s Industrial, Collaborative & Commercial Robotics research service, which includes research, data, and ABI Insights. Market Data spreadsheets are composed of deep data, market share analysis, and highly segmented, service-specific forecasts to provide detailed insight where opportunities lie.