Blog

5 takeaways from top global industrial robotics survey

The 2022 McKinsey Global Industrial Robotics Survey reveals how industrial companies plan to spend on robotics and automation in the coming years, and how they have spent over the past few years.

The survey found, in general, that industrial companies are set to spend heavily on robotics and automation, with automated systems accounting for 25% of capital spending over the next five years. In fact, from January through September 2022, North American companies purchased 24% more robots than the same period in 2021, and that trend is only expected to accelerate.

The survey provided many insights into the robotics and automation industry, discussing automation spending, barriers, use cases, and more. Here are the top five:

1. While investment in automation will increase substantially across all industries, it will be most prevalent in the logistics and fulfillment industry

Over the next five years, the industry with the highest average share of investment in automation will be the logistics and fulfillment industry, representing over 30% of capital spending. Logistics and fulfillment is followed by automotive, life sciences, healthcare and pharmaceuticals, and food and beverage. This is representative of the trend over the past five years

However, the retail and consumer goods industry, which ranked lowest for percentage of capital spending on automation, is expected to spend the most in dollar value on automation and robotics, with 23% of respondents planning to spend more than $500 million.

While spending on automation and robotics differs between industries, the rising trend is still clear. Automation and robotics is increasingly being adopted across all industrial companies to improve productivity.

Ongoing labor shortages, easier-to-use robotic solutions and new industries embracing robotics, such as restaurants, retail, construction, and even agriculture, have led to record units sold here in North America this year. Investing in automation is increasingly seen as a necessary step for performing many of the difficult-to-staff tasks that are necessary to compete today, and we see 2022 ending on another record high.

Jeff Burnstein

President, A3

OTTO Motors works with a variety of industries to implement automation and improve processes across the supply chain. Our customers range across a variety of industries, including automotive with customers like Toyota and Faurecia, printing and packaging with customers like Mauser and Cober Solutions, and food and beverage with customers like Keurig.

Whether you’re a printing company, a warehousing company, or an auto parts company, OTTO can still add value. For us, high efficiency printing is a really high efficiency material handling.

Todd Cober

Vice President, Cober Solutions

2. Routine tasks like material handling will top the list of activities to be automated in the next five years

Routine tasks, like palletizing and packaging, material handling with forklifts and through ground movement, goods receiving, unloading and storage, and sorting are easy tasks to automate. These tasks do not require the critical thinking skills of humans and thus will see substantial investment in automation over the coming years. Conversely, tasks which require high levels of human input, such as assembly, stamping, surface treatment and welding will be less likely to be automated in the coming years.

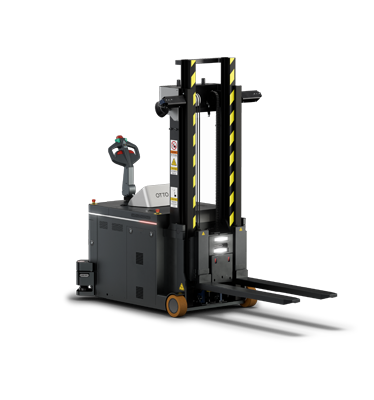

At OTTO Motors, we automate material movement for industrial companies like those surveyed to improve safety, efficiency and productivity. We provide both flatbed and forklift autonomous mobile robots (AMRs) to:

- Bring materials to and from people

- Bring materials to and from automation equipment

- Bring materials to and from racks and near the floor

- Transport pallets to and from the floor and stands

3. Industrial companies list quality, speed of production and delivery, and production capacity as the top reasons to automate processes

As an increasing number of industrial companies look to automate processes in the next five years, many benefits are expected, including the ability to work faster and at a higher capacity, and to provide high quality. Upsides to automation were also found to include cost, operational uptime and safety.

Material handling is a particularly dangerous task, leading many industrial companies to consider automation as a safer alternative. In fact, according to OSHA, there is a 90% chance of a serious accident occurring during the 8-year average lifespan of a forklift, with material handling as the leading cause of compensable injuries in the American workplace.

OTTO AMRs, however, are equipped with safety sensors and LiDARs, as well as over four million production hours, improving safety for industrial companies that automate material handling. For example, at Sunview Patio Doors, OTTO achieved a 100% safety rating alongside a 16-month ROI.

OTTO provides other benefits for customers as well. At GE Aviation, OTTO helped the company save $1.3 million within one year of AMR implementation, while Faurecia Interior Systems saw a 15% reduction in work cell size. OTTO AMRs also helped Berry Global fill some of their 50,000+ open job postings. Cober Solutions has improved efficiency with cycle times reduced to 30 seconds, GE Healthcare has seen a 66% increase in productive floorspace, and Mauser Packaging enhanced throughput by 600%. OTTO Motors exemplifies each of the many reasons industrial companies are increasingly looking to automate.

No other AGV or AMR provider offered us the same uptime and productivity. OTTO is the only AMR that offers 13 hours of continuous runtime at top driving speeds of 2m/s with the highest payload rating. Another essential factor was OTTO's ability to be easily integrated and customized to fit our plant's specific needs and objectives.

Wojciech Tymczak

Corporate Automation Engineer, Mauser Packaging Solutions

4. Industrial companies list cost and lack of automation experience as their biggest barriers to automate processes

For those industrial companies that aren’t quite ready to automate their processes, the biggest barriers stopping them included the cost of hardware (61%) and the lack of internal automation experience (71%). Specifically in the retail and consumer goods industry, 60% of respondents cited return on investment as a barrier to progress.

However, with the right automation provider, the return on investment for AMRs can be quick and substantial. Your robotics provider should help you implement automation, making your first instance of adoption a positive and uncomplicated experience. With OTTO Motors, both Faurecia Interior Systems and Danfoss Power Solutions saw an 11-month ROI while improving response times and reducing delivery lead times in mission-critical operations.

Other barriers to automation reported include the concern that automation will eliminate jobs. However, automation does not remove jobs; instead, it repositions valuable workers to more fulfilling, higher paid roles which require critical thinking. With over half of the 4.6 million manufacturing jobs projected to be created by 2028 going unfilled because of a labor shortage, reallocating the available labor to high value tasks is essential. Automation can fill those open positions by doing routine tasks like material handling and sorting.

The jobs that robots fill include repetitive tasks like assembly, packaging, and rapid painting and welding. Needless to say, those are not the most desirable positions. But robots don’t replace positions that require critical thinking and collaboration which are often more rewarding.

Robotic Industries Association

5. The most successful robotics and automation providers will offer more than just a robot

Robotics and automation providers need to provide services on top of their robotics offering. The most successful providers will be the ones that can help industrial companies overcome challenges, including technology selection, implementation, planning and rollout. Suppliers need to provide a product that is cost-efficient, rapidly deployable, safe and scalable, such as OTTO Motors which has uniquely and demonstrably scaled up to 100 robots without efficiency losses. Industrial companies also list quality of product, ability to offer integrated solutions and provision of reference case studies as their biggest buying factors.

Furthermore, 62% of industrial companies surveyed also prefer a supplier that can provide full-service models for implementation. These are models that not only offer installation and integration, but also maintenance and support throughout the robot’s lifecycle. Those suppliers that move toward robotics-as-a-service and act as a single point of contact for both hardware and software maintenance will create a distinctive competitive advantage.

OTTO Motors’ Technical Documentation no-login hub ensures end-to-end online support for setup and troubleshooting, providing essential information to keep your fleet moving. If the answer isn’t available on our easy-to-use, intuitive hub, our experts are just a phone call away as your single point of contact for maintenance and support. OTTO is certainly more than just a robot.

Over the year and a half that we've had [OTTO AMRs], we've always had 24/7 support from OTTO. Their technicians are very familiar with our factory, they're very familiar with the software and the OTTOs themselves, and 90% of the time with the one-call support we'd be able to resolve any issues right away. Since we run a 24/6 operation, it's important to have good service quality and in times like this where most companies are not service-oriented over a 24-hour period, OTTO was a very good solution.

Chris Newby

Engineering Director, Faurecia Interior Systems

Industrial companies around the world and across many industries are investing in automation to improve efficiency, quality, safety, and more. They’re also choosing the right suppliers which provide high quality robots as well as service and support. As investment grows, it’s important for manufacturing facilities and warehouses to consider which of their processes are ripe for automation and which supplier is right for them.