Blog

Warehouse automation market to hit $27B by 2025

Originally posted by Robotics Business Review on September 12th, 2019.

Research firm LogisticsIQ recently reported that it expects the growth of the material handling equipment market in general, and automated warehouse solutions in particular, to be driven by several key industrial and macro trends. Among the industrial trends, the company sees the adoption of new technologies relating to the (Industrial) Internet of Things, increased pressures on and demand for efficient and flexible distribution operations, and growth in use of automated solutions across key end markets.

Technology availability

As part of their efforts to boost productivity and margins, companies are increasingly adopting data analytics tools to identify areas of improvement, which also holds true for logistics and warehouse operations. The combination of sensors, scanners and RFID tags with warehouse control systems and automated material handling equipment is increasingly seen as the way forward in terms of warehouse safety and operational efficiency. The same technology allows real-time identification and tracking of inventories, further helping to streamline the logistics process and reduce error potential.

Rising customer expectations

The rapid rise of global e-commerce and expectations for shorter delivery times are further increasing the pressure on distribution operations, particularly in high-volume areas like online grocery retailing where online penetration and proliferation should grow across several markets, in particular high-density urban areas.

Increasing manufacturing complexity

A move towards the Industrial Internet of Things and increased customization of products, e.g. cars, is a further growth driver for this industry as manufacturers require easy access to growing numbers of components with very little room for material handling errors.

LogisticsIQ latest market research study estimates that the global Warehouse Automation Market will grow more than 2x from $13 Billion in 2018 to $27 billion by 2025, at a CAGR of 11.7% between 2019 and 2025.

Chart 1: The warehouse automation market will continue to grow over the next six years.

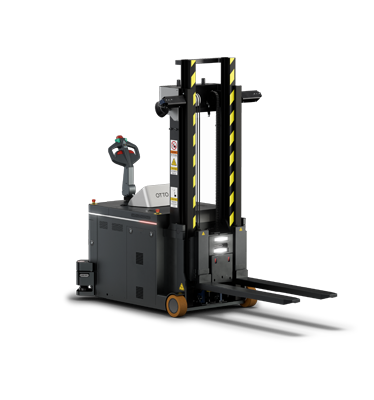

As per the LogisticsIQ market study, AGV/AMR market is expected to cross $4 billion mark by 2025 and AMRs (without any external support of optical tape, sensor or vision) are going to be main contributors in retail warehouses, due to high demand in e-commerce sector and its flexibility to deploy the robot without any major change in the existing warehouse infrastructure. LogisticsIQ market study estimates that AGVs/AMRs are going to have more than 15% market share in overall warehouse automation.

Also, it is expected that mobile robots will help the companies to lower down their increasing labor cost. It is getting popular in countries where a Logistics Performance Indicator (LPI) score is high but there are some exceptions like China where demand is too high due to e-commerce wave and disruption in the automotive and manufacturing sector. If we do consider AGV, AMR and Picking Robots to be a combined market, then they are expected to have more than 40% market share in Warehouse Automation Market by 2025.

Chart 2: AGVs and AMRs (including SDVs) will occupy 14.7% of the warehouse automation market.

LogisticsIQ sees substantial growth opportunities in the warehouse automation equipment space owing to several structural trends in consumer demand within eCommerce, retailing and third-party logistics providers.

Automation is a must for customer fulfillment

Meeting customer demands within e-commerce requires increased adoption of warehouse automation solutions to keep costs and operational complexity in check. Online retailing is fundamentally a logistics business driven by margin improvement from cost reduction in inventory management, order fulfillment and delivery capabilities.

Scalable solutions enable growth

Double-digit growth in e-commerce and online grocery sales is driving players to expand capacity to deliver required volumes. Warehouse automation solutions are built for scale and can deliver higher output and more accurate order fulfillment than a manual setup at lower operating costs and can increase the customer satisfaction as well as improve margins by reducing the delivery time as well as cutting down on the cost of wrong orders.

Cost efficiency and quality

Automated and robotic solutions are easing the increasing pressure felt by online grocery retailers to get orders out to customers more efficiently while reducing fulfillment costs. Warehouse automation solutions can both increase picking speed and volumes while decreasing picking inaccuracy due to a reduction in the number of human interactions. In addition, robots are independent of labor market conditions and can work 24/7 without requiring any overhead costs such as pensions, health insurance, vacations or breaks. They also do not require training, an extra cost associated with the additional or temporary hires necessary during the peak shopping cycles. There remains the need for capital expenses to be incurred at the beginning of operations, and ROI calculations are a key criteria for any retailer looking to implement warehouse automation. The ROI keeps improving as the cost of manual trained labor force is increasing, as well as the cost of “mis-pick” can tend to shift customer loyalty.

Efficiency

The spatial savings from reduced warehouse footprints can be up to 85% and reductions in operational costs of up to 65%. Space savings are achieved primarily through storing SKUs higher and denser, and reductions in operational costs are resulting from decreased demand for manual labor.

Effectiveness

Warehouse automation solutions result in faster process times and reduced picking errors, and hence improved service levels. The speed at which an order can be accurately picked and shipped, increases the reliability of the customer’s delivery service, and makes operations more flexible in terms of handling late changes.

Optimization of operations

Warehouse automation solutions can be optimized through programming for continuous improvement in processes such as dynamic storage, inventory management and overnight relocation of goods. Warehouse Management Software provides cataloging of inventory and improves end-consumers’ experience from connectivity and real-time data.

Considering the challenges of the current market scenario including high customer expectations, players don’t have any other option left than deploying these disrupting technologies in their warehouses and fulfillment centers to be part of this race. In the last 2-3 years, more than 30 young companies have been started including an investment of approximate $350 million. In 2017, $178 million was raised for AMR/AGV startups, and is expected to be more than $5 billion by 2025.